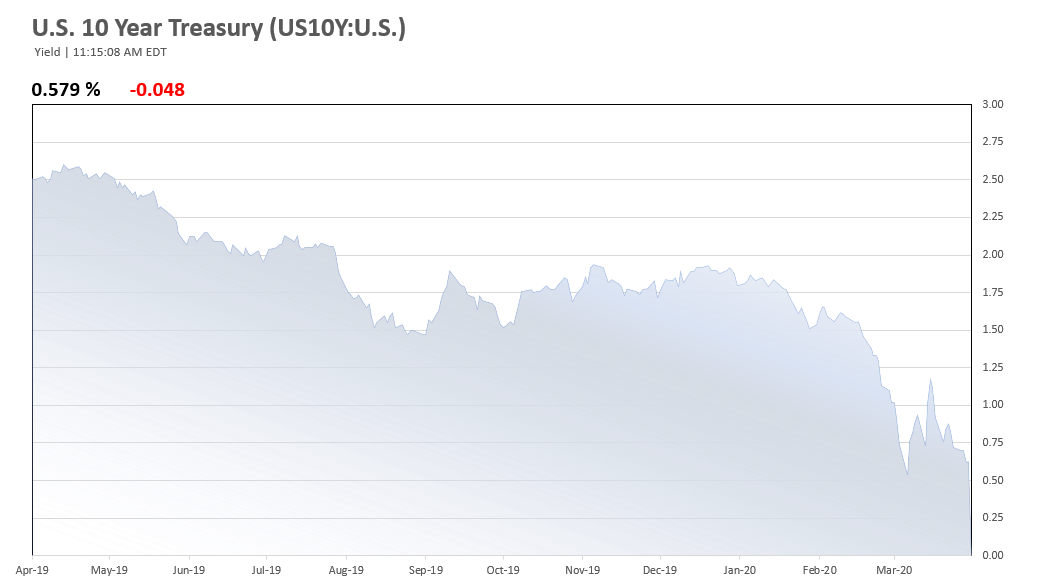

The Fed has taken extraordinary steps to provide liquidity in the market through the expansion of its QE policies in response to the fallout from the novel Coronavirus. The Fed tossed its previous commitment to purchase $700 billion in Treasuries and agency MBS in favor of an open-ended program, pledging asset purchases with no limit to support markets. With the acceleration of Treasury and agency MBS purchases, the Fed’s balance sheet has ballooned to record levels, now above $5 trillion. The immediate impact on interest rates have been positive as spreads have come down, although the situation remains fluid. Check out today’s rates.

FHA Commercial Loan Rate Update – April 03, 2020

- 35-year fixed FHA perm loans: 2.60%-2.85%

- 40-year fixed FHA construction/perm loans: 3.35%-3.60%

These pricing indications are current as of the date posted, subject to market interest rate volatility. Pricing of FHA insured apartment and healthcare loans may be dependent on loan size and other risk factors. Call for more information.

Interested in learning more about FHA's attractive 223(f) refinance loan program?

Click to learn more!