With U.S. inflation surging to a new four-decade high of 8.5% in March, the Fed at its March meeting raised the federal funds rate by 25 basis points, the first such rate hike since the end of 2018, and signaled 6 forthcoming rate increases in 2022. The Fed also released a statement stating that it expects to begin reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities.

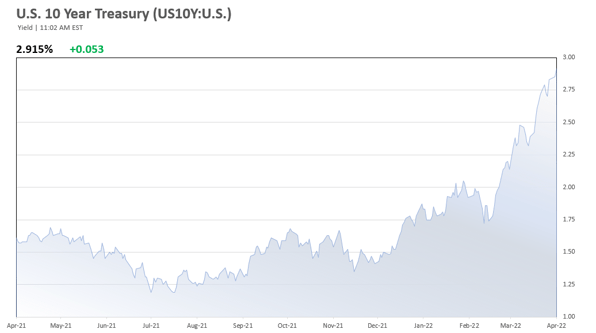

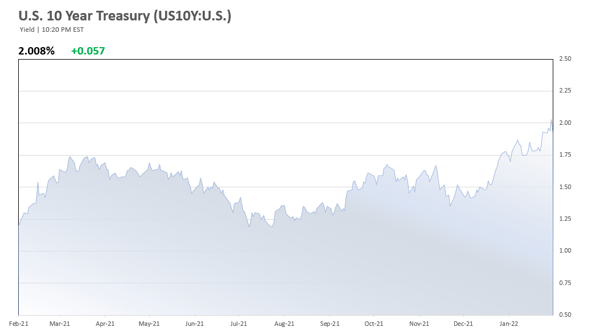

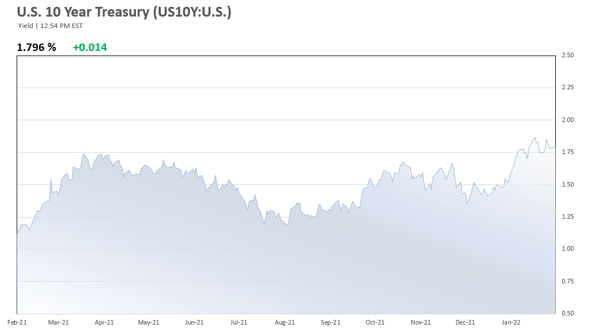

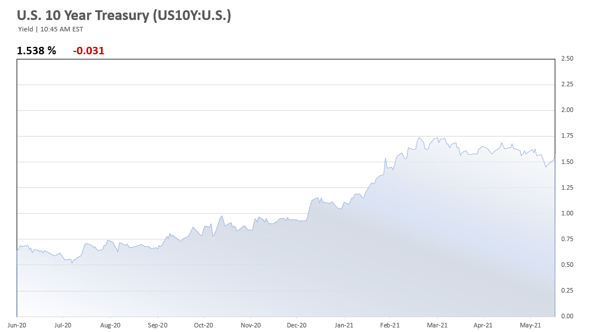

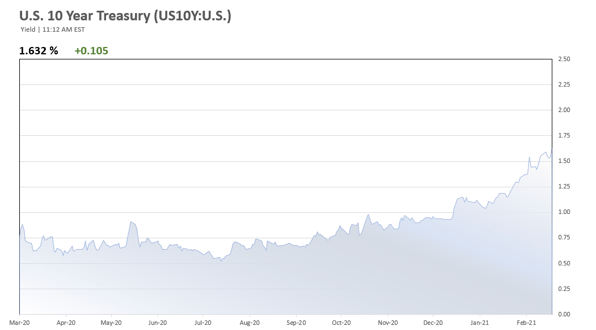

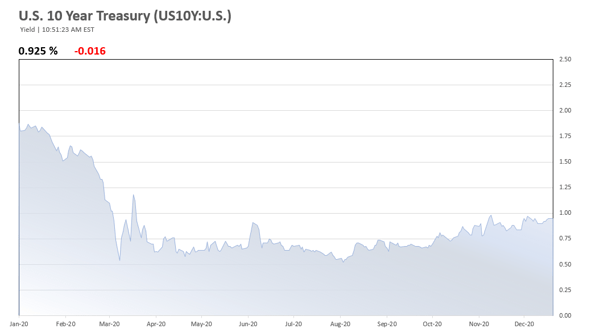

The combination of Fed’s short-term interest rate hikes and ending its purchases of long-term debt has sent interest rates soaring. The average rate on the popular 30-year fixed mortgage is now above 5%. The yield on the US 10 Yr is now hovering around 2.90%, up approximately 90 basis points over the past 8 weeks since our prior update. Over the same period, HUD commercial interest rates have climbed 30 basis points and are up approximately 80-90 basis points on the year. Check out today’s rates.

HUD Commercial Loan Rate Update – April 19, 2022

- 35-year fixed FHA perm loans: 3.75%-4.00%

- 40-year fixed FHA construction/perm loans: 4.30%-4.65%

These pricing indications are current as of the date posted, subject to market interest rate volatility. Pricing of FHA insured apartment and healthcare loans may be dependent on loan size and other risk factors. Call for more information.

Interested in learning more about FHA's attractive loan programs?

Click to learn more!